$100 Loan Instant App Fundamentals Explained

Wiki Article

Our Best Personal Loans Statements

Table of ContentsUnknown Facts About Best Personal LoansSome Known Factual Statements About $100 Loan Instant App What Does Instant Cash Advance App Do?The Definitive Guide to Best Personal LoansThe 5-Minute Rule for Instant LoanLittle Known Questions About Instant Cash Advance App.

When we assume concerning getting finances, the images that comes to mind is people aligning in lines up, awaiting countless follow-ups, as well as obtaining absolutely distressed. Innovation, as we understand it, has actually altered the face of the borrowing organization. In today's economic situation, consumers and also not lenders hold the key.Car loan approval and also paperwork to lending handling, whatever is online. The several trusted online lending applications offer borrowers a system to make an application for lendings quickly and also offer approval in mins. You can take an from some of the very best money car loan apps offered for download on Google Play Shop and Application Store.

You just have to download and install the application or most likely to the Pay, Sense website, authorize up, publish the needed files, as well as your finance will certainly get authorized. You will certainly obtain informed when your funding demand is refined. Traditionally lending application made use of to take at the very least a few days. In some instances, the lending approval utilized to get extended to over a month.

The 6-Second Trick For Best Personal Loans

Often, even after obtaining your finance authorized, the procedure of obtaining the financing amount transferred to you can take some time as well as obtain made complex. However that is not the instance with on the internet car loan apps that supply a direct transfer option. Instant lending apps provide instant individual finances in the variety of Rs.

You can get of an instant car loan as per your qualification and need from instant finance apps. You do not have to worry the following time you desire to make use of a small-ticket finance as you recognize how valuable it is to take a financing utilizing on-line funding applications.

The Ultimate Guide To Loan Apps

You can be sure that you'll get an affordable rates of interest, tenure, financing amount, and various other benefits when you take a funding with Pay, Feeling Online Financing Application.A digital borrowing platform covers the entire car loan lifecycle from application to dispensation right into clients' savings account. By digitizing and automating the lending procedure, the system is changing typical banks into digital lenders. In this article, let's discover the benefits that a digital financing system can offer the table: what remains in this post it for both financial institutions and also their customers, and also just how digital lending systems are disrupting the industry.

They can even check the bank statements for info within only seconds. These features aid to make sure a rapid as well as convenient individual experience. The digital banking landscape is currently a lot more dynamic than ever. Every bank currently wants everything, including fundings, to be processed quickly in real-time. Clients are no longer happy to wait on days - and also to leave their homes - for a financing.

$100 Loan Instant App Fundamentals Explained

All of their day-to-day activities, including monetary deals for all their activities and they favor doing their financial transactions on it too. They want the convenience of making purchases or applying for a financing anytime from anywhere - loan apps.In this situation, electronic financing platforms work as a one-stop option with little manual information input and also quick turn-around time from lending application to cash in the account. Customers must have the ability to relocate perfectly from one device to one more to finish the application types, be it the internet and also mobile interfaces.

Service providers of digital loaning platforms are required to make their products in conformity with these policies and also help the lending institutions concentrate on their company only. Lenders also needs to ensure that the carriers are upgraded with all the latest guidelines provided by the Regulators to rapidly integrate them right into the electronic lending platform.

The Main Principles Of Best Personal Loans

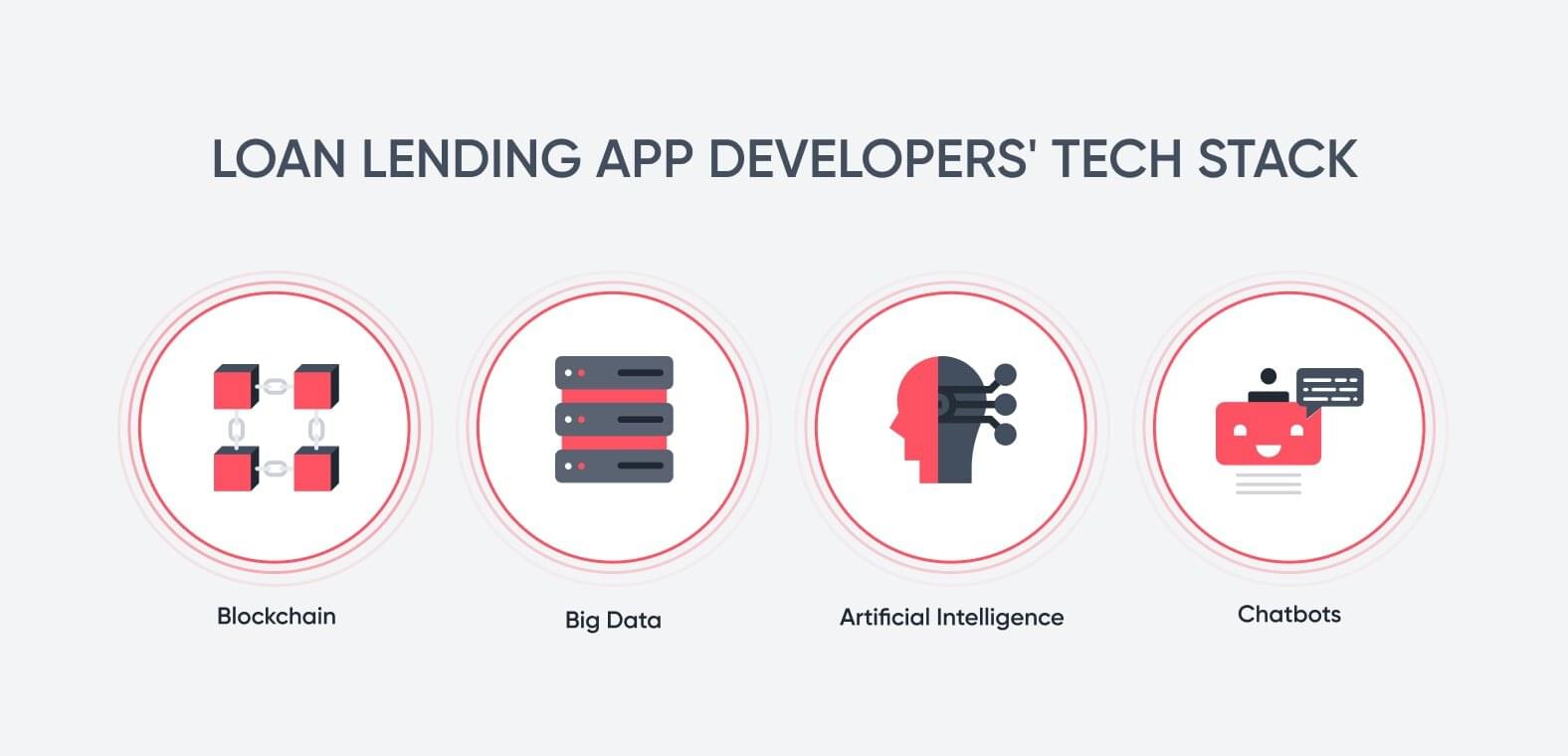

As time passes, electronic loaning systems can assist in saving 30 to 50% overhead prices. The conventional hand-operated lending system was a discomfort for both lender as well as borrower. It relies upon human intervention as well as physical interaction at every action. Consumers had to make numerous trips to the financial institutions as well as send all type of documents, and also manually fill in several forms.The Digital Lending system has altered the method financial institutions believe concerning and apply their funding procurement. Financial institutions can currently deploy a fully-digital lending cycle leveraging the most recent technologies. A great electronic lending platform must have very easy application entry, fast approvals, compliant financing procedures, More about the author and the ability to continuously improve process effectiveness.

If you're assuming of going right into borrowing, these are calming numbers. At its core, fintech is all concerning making traditional economic procedures much faster as well as a lot more discover this effective.

7 Easy Facts About Instant Cash Advance App Explained

One of the common misconceptions is that fintech apps just profit economic institutions. That's not totally real. The application of fintech is currently spilling from banks as well as loan providers to local business. This isn't surprising, since small companies require automation and also electronic modern technology to optimize their restricted resources. Marwan Forzley, chief executive officer of the payment platform Veem, sums it ideal: "Little organizations are seeking to outsource complexity to someone else since they have sufficient to fret about.A Kearney research backs this up: Source: Kearney As you can see, the ease of usage tops the checklist, demonstrating how availability and comfort supplied by fintech platforms stand for a substantial motorist for consumer loyalty. You can apply many fintech innovations to drive customer trust fund and retention for organizations.

Report this wiki page